german tax calculator for married couples

However tax is only paid on the amount that exceeds the non-taxable minimum of. Generally speaking the higher your taxable income in Germany the higher your rate of taxation.

Joint Taxes In Germany 2022 Ehegattensplitting Explained

Feeder mice near rome metropolitan city of rome.

. Income up to 9984 euros in 2022 is tax-free Grundfreibetrag. If you only have income as self employed from a trade or from a rental property you will get a more accurate. German Income Tax Calculator 1999-2016.

Owes annual German income tax of 2701. Note 1 on 2022 German Income Tax Tables. This is a sample tax calculation for the year 2021.

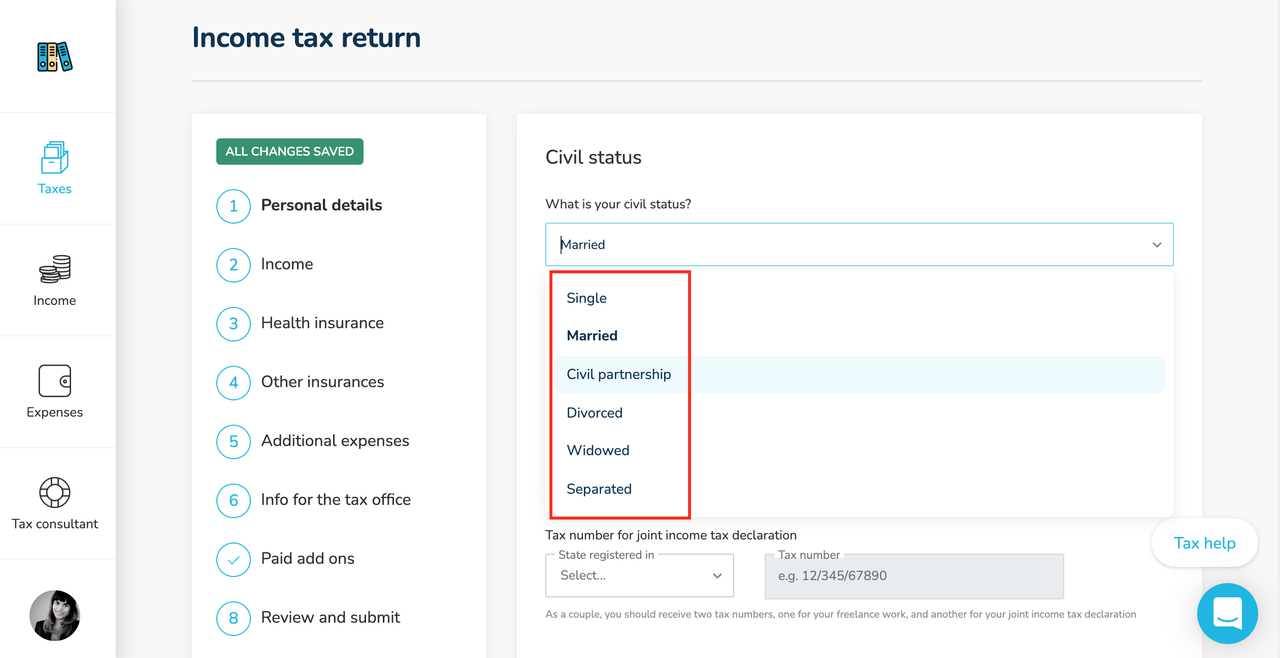

This will generate your estimated amount for your Profit. If married AND couple taxation is opted for first both incomes are added up. For couples who are married or in a civil partnership the maximum tax rate is of 45 only applies if you earn more than 501460 euros.

Tax Category Children from Tax Card being Parent. Dodge challenger 1970 for sale germany. German Wage Tax Calculator 2010-2015 GrossNet and NetGross-Calculation.

Youll then get a breakdown of your total tax liability and take. The Federal Central Tax Office Bundeszentralamt für Steuern BZSt offers an income tax calculator which estimates the percentage of income tax you have to pay. Tax bracket 4 can only be selected by married people if both earn at least 450month.

First add your freelancer income and business expenses to the calculator. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. German Wage Tax Calculator Expat Tax.

75000 EUR 0 EUR 75000 EUR. This sum rises in 2014 to 8354 EUR. For every euro that you earn more the tax burden will rise.

2022 2021 and earlier. Geometrically progressive rates start at 14 and rise to 42. Gross salary of one spouse of EUR 100000.

Income tax Einkommensteuer Lohnsteuer on wages in Germany ranges from 14 to 45. As you can see above the tax allowance is double for a married person. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Germany affect your income.

It is a progressive tax ranging from 14 to 42. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets. Income tax in germany for foreigners.

An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. If your income falls. Singles can earn 8130 EUR per year tax free.

Simply enter your annual salary to see a detailed tax calculation or select the advanced options to edit. If your income falls within the second tax bracket and you earn a gross salary of 25000 you are likely to be taxed at a rate of 29 per cent. If not married Johns tax would be 42 x 75000 EUR - 878090 EUR 22719 EUR.

Married couples can double that sum. Start tax class calculator for married couples. Income more than 58597 euros gets taxed with the highest.

Gross Net Calculator 2022. Online Calculators for German Taxes. The child allowance for 2019 is 7620 for a.

It is very easy to use this German freelancer tax calculator. Calculation for December 2015. Married couple with two dependent children under age 18 years.

Overall tax for the couple when paying tax separately. Then divided by two. If you are married then you may get considerable income tax advantages in Germany.

Beagle weight calculator. Based on a JavaScript program created by Slaven Rezic. Husband John earns 75000 EUR taxable income his wife Mary earns 0.

The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year. Owes annual German income tax of 17028. This Wage Tax Calculator is best suited if you receive a salary only as an employee on a German payroll.

In addition this is only possible if both spouses would like to be in the same tax. Easily calculate various taxes payable in Germany.

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

How Does The Uk State Pension Work For Migrants Low Incomes Tax Reform Group

German Income Tax Calculator Expat Tax

German Wage Tax Calculator Expat Tax

German Income Tax Calculator Expat Tax

Tax Classes In Germany Relosophy

Life Insurance And Inheritance Tax Forbes Advisor Uk

Find Ideal Tax Class For Working Married Couple Eazyleben

Taxes In Switzerland Income Tax For Foreigners Academics Com

German Income Tax What You Should Know As A Foreigner Sib

What Are Marriage Penalties And Bonuses Tax Policy Center

9 Tips To Pay Less Tax In The Uk

Landmark Mortgage Rates Lowest Mortgage Rates Online Mortgage Mortgage Rates

Income Tax In Germany For Expat Employees Expatica

Landmark Mortgage Rates Lowest Mortgage Rates Online Mortgage Mortgage Rates